Retirement funding gap

A rising number of Australians face the brutal prospect of working until they die if they want a comfortable lifestyle beyond retirement age.

Low median superannuation balances, COVID early-release super withdrawals and record-low interest rates are leaving many savers without enough money to retire comfortably. Unaffordable housing and retirees saddled with mortgage debt compound the problems.

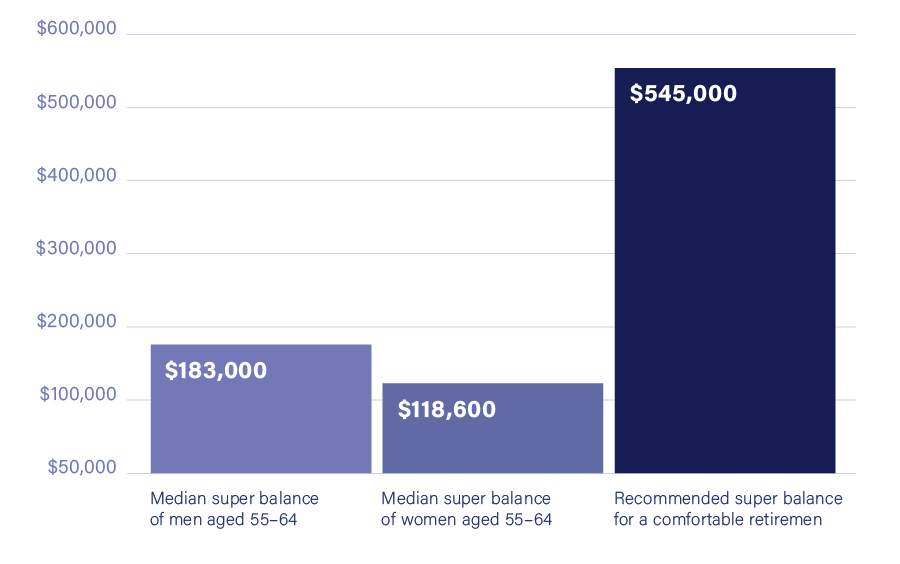

The latest data from the Australian Bureau of Statistics shows the median super balance of men aged 55 to 64 is $183,000 and for women it is $118,600.

However, to retire comfortably an individual requires $545,000 and a couple $640,000, according to widely-respected calculations from the Association of Superannuation Funds of Australia.

If people don’t start to look at their financial situation and set goals and a plan in place, it may well be the majority will have to “work till they die” as they are not going to have enough money to retire.

“We are now seeing people who have retired coming back into the workforce after two or three years because they realise they actually can’t attain their aspirational retirement lifestyle.”

If this is the case, will we see roll reversals as the Bank of Mum and Dad becomes the Bank of Sons, Daughters and Friends?

More than 70 per cent of people now worry about their retirement security, according to a new survey commissioned by the Australian Institute of Superannuation Trustees.

Association of Independent Retirees president Wayne Strandquist says the age pension remains a vital safety net for many.

The Reserve Bank’s forecast of not raising the official interest rate above its record low of 0.1 per cent until 2024, and these ultra-low interest rates are having a dramatic impact on seniors relying on investment income.

“Term deposits are not good – when you go from 4 per cent to 0.4 per cent that’s a tenth of what you used to get” he said.

The age pension pays a single person up to $953 a fortnight and a couple $1436. Mr Strandquist said it was crucial to help those whose financial situations saw them “slip through the net”.

“We have to have a system that picks people up,” he said.

People who seek Financial Planning advice mostly do not have to worry about retirement poverty. As part of the process, they set goals and track their progress to ensure a comfortable retirement.

“Everybody has the option of receiving advice or doing something for themselves” he said.

How much Super should you have now?

Super industry group ASFA says $545,000 is required for a comfortable retirement including travel, a nice car, top health insurance, good clothes, restaurant meals and other leisure activities.

Super balance required by age:

| 25 | $17,000 |

| 30 | $54,000 |

| 35 | $93,000 |

| 40 | $143,000 |

| 45 | $195,000 |

| 50 | $257,000 |

| 55 | $330,000 |

| 60 | $415,000 |

| 65 | $503,000 |

Remember there’s always an age pension safety net – about 70 per cent of retirees receive a full or part pension.